The main purpose of a company is to be profitable and satisfy its shareholders. However, business must be done in a sustainable and responsible way. Companies should be responsible for their actions and develop their business according to standards which allow them to thrive respecting all the stakeholders and the environment. For example, a company should be responsible to produce their goods in the most environmentally friendly way possible, to assure the future of our planet.

What is CSR?

Having these ideas in mind, the concept of Corporate Social Responsibility appeared:

Corporate Social Responsibility (CSR) refers to the awareness, acceptance and management of the wider implications of corporate decisions.

(Boddy, 2020).

The concept emerged in the 1950s but since the beginning had adversaries. For example, Levitt, 1958 stated that the only two responsibilities of businesses is to be honest, act in good faith and make material gain. Milton Friedman is the most prominent opponent of CSR. The economist stated that “social issues are not the concern of business people and that these problems should be resolved by the unfettered workings of the free market system” (Carrol, 2016).

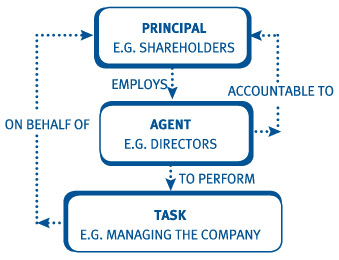

However, many concerns arose about the way to perform business and the concern to consider other stakeholders rather than only the shareholders. The shareholders are represented in the Board of Directors of the company (agency theory) but the remaining stakeholders are not represented, neither is the general interest of society or environment. In agency theory, the stakeholders are the principal who employ the agent who, in their turn, are accountable to the principal.

We can summarize CSR has being “understood as policies and practices that business people employ to be sure that society, or stakeholders, other than business owners, are considered and protected in their strategies and operations” (Carrol, 2016).

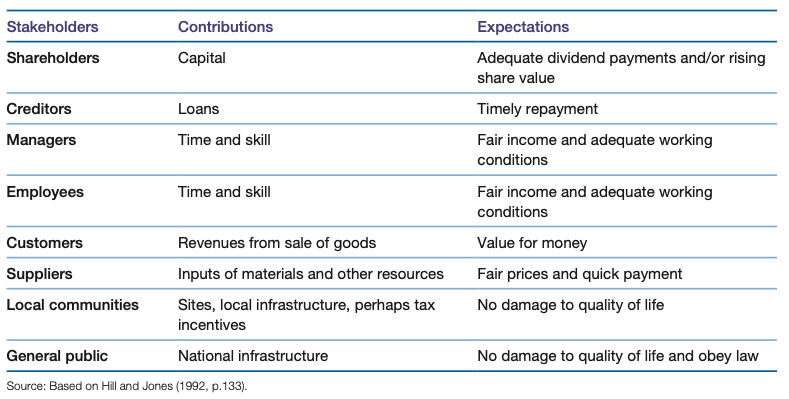

As we can confirm, different stakeholders have different expectations. Many times they can be conflicting, for example, making profit and paying dividends can be contradictory not damaging the quality of life or the environment. However, if all the stakeholders are taken into consideration, their interests are likely to be more aligned.

United Nations’ Sustainable Development Goals (SDGs)

A model for CSR

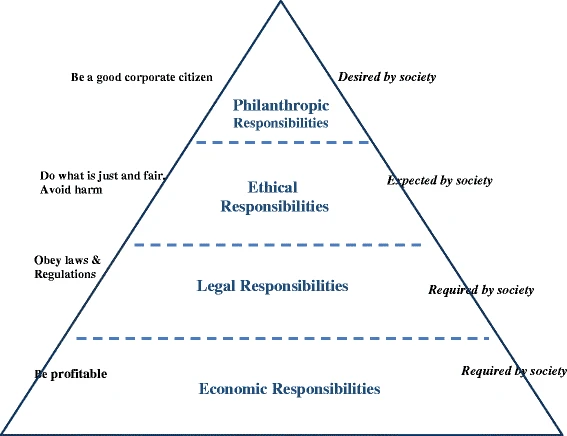

Caroll, 1999, developed a model of CSR in a pyramid form. This model was based on a free-market economy and particularly in the USA model of conducting business. Therefore, there are some concerns that the model is not globally applicable as other regions might have different stages of development or other ways to conduct business.

Model Highlights

The models highlights 4 main responsibilities that companies should follow:

Economic

Managers should meet their economic responsibilities, in other words, make sure that the company is profitable and provides returns to the shareholders. Being economic viable is vital to the company, shareholders but also to the society in general. It is expected that businesses are capable of sustaining themselves and be profitable. In a capitalist society, private initiative is crucial to development.

Legal

Laws are the rules by which businesses are expected to function. Society expects managers to obey the law by not misleading investors, exploiting staff or selling faulty goods. Businesses are expected to comply with local, national and international laws. In a multinational company, this has implications as it must comply with different laws.

Ethical

While society depends on business to provide products and services, business in turn depends on society, for educated employees, capital and a good physical infrastructure. It also depends on the socially created institutions that enable business to operate, such as legal, political and cultural systems. Ethical responsibilities are mainly not codified in law but are expected by the society. Both legal and ethical responsibilities share the ethical component but the difference is in the codification by law that society has demanded businesses. Businesses are expected to perform in a way that respects moral standards, respecting new ethical norms, act morally and ethically, recognize that business ethics go beyond mere compliance laws (e.g.: a company might respect environmental norms but could go beyond that by supporting the use of public transportation). Obviously, there are greater morally and ethical norms that should be respected above all such as human rights or justice.

Philanthropic

This covers areas of behavior that are entirely voluntary as it is not required by law that a business pursues philanthropic responsibilities. Philanthropy is not required in a moral or ethical sense. They include anonymous donations with no possibility of a pay-back, sponsorship of local events, or contributions to charity.

Ethics as transversal

As moral principles ruling a person or company’s behavior, ethics permeates the entire pyramid as all the other categories should follow ethical principles. For example, the economic responsibility states the responsibility to be profitable within a capitalist society that views profit as legitimate. However, a capitalist society also finds appropriate that businesses which perform under ethical principles should merit a return on their investments.

Besides, ethical principles are not the same globally. Companies must consider this aspect and respect local moral and ethical principles. However, can there be a conflict if a multinational company operates in markets with radically different ethical and moral principles? Let’s think about an European company following European moral and ethical principles that produces in developing countries with low labor regulation. This means the company could be employing people without the standard working conditions in Europe just to fulfill its economic responsibility. Which local ethical principles should the company adopt? In this case all the other responsibilities could be met.

A model for ethical decision-making

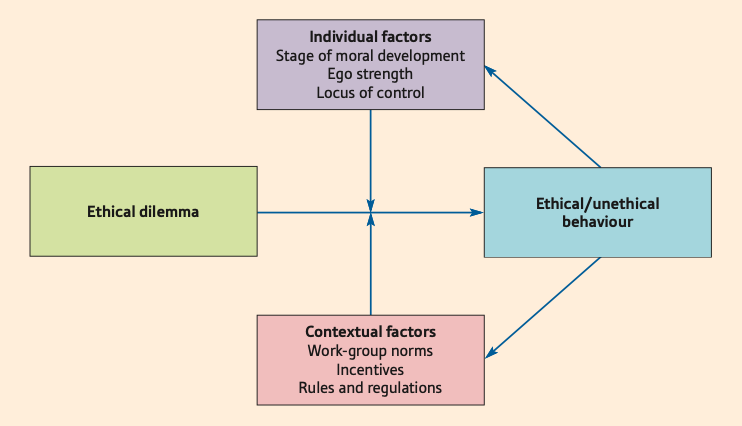

Boddy, 2020 proposes a model of ethical decision-making that states that when confronted with an ethical dilemma, the response depends on individual and contextual factors. The model examines the influence of individual characteristics and organisational policies on ethical decisions.

Individual factors

Stage of moral development

The extent to which someone can distinguish between right and wrong; the higher this is, the more likely they will act ethically.

Ego strength

The extent to which someone can resist impulses and follow their convictions; the greater this is, the more likely they person will do what they think is right.

Locus of control

The extent to which someone believes they control their life; the more they see themselves as having control, the more likely they will act ethically.

Contextual factors

Work-group norms

Beliefs within the group about right and wrong behavior.

Incentives

Management policies on rewards and penalties.

Rules and regulations

Management policies about acceptable behavior.

Ethical feedback

This model has a feedback loop as the behavior that the company or individual take, has consequences at the individual and context levels, influencing future actions (i.e.: if an unethical behavior goes unpunished it is likely to repat itself).

CSR and Strategy

A review of recent trends in CSR revealed that besides showing that a company creates value for shareholders, it is currently being pushed to show how its strategy is aligned to CSR policies (Boddy, 2020).

Strategy Alignment

A company could align its strategy with CSR measures as follows:

Philanthropy

Philanthropic activities are not intended to produce a profit or to benefit the business directly, other than by promoting a positive image. They are essentially returning some of the wealth created by the company to the society in which it operates, by supporting sporting, cultural or other work.

Sustainable operations

Most activities can be re-designed to use fewer resources and make less waste. For example, industries that use a lot of electricity are investing in renewable energy supplies, especially wind and hydro-electric.

Creating shared value

Many managers perceive their role as purely economic and financial. This causes a legitimacy problem and does not fulfill consumer needs which may probably include sustainability. Porter and Kramer (2011) propose that companies are likely to perform well if they aim to create shared value, by balancing the interests of many stakeholders.

Powering the Future

Energy is probably the most important concern for the future. The way we produce and consume energy might be key to a global sustainable development and to tackle climate change. This video helps you reflect on the future of the energy and their implication. As traditional renewable energy seems to not keep the pace with the need to mass green energy production, other alternatives could be found. Green hydrogen is one of them and has become popular due to the issues found in electric cars, mainly concerning the massive amount of energy needed to produce batteries as well as their main component (lithium), which is not environmental friendly.

Resources and References

Main

- Barney, J. & Hesterley S. (2019). Strategic Management and Competitive Advantage: Concepts and Cases. 6th Edition, Pearson.

- Grant, R. (2018). Contemporary Strategy Analysis. 10th Edition. Wiley.

Secondary

- Adam Brandenburger and Barry J. Nalebuff, Co-opetition (New York, NY: Doubleday, 1996)

- Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management.

- Bredrup, H. (1995). Competitiveness and Competitive Advantage. In: Rolstadås, A. (eds) Performance Management. Springer, Dordrecht.https://doi.org/10.1007/978-94-011-1212-3_3

- Boddy, D. (2020). Management: Using Practice and Theory to Develop Skill (8 ed.). Reino Unido: Pearson.

- Carroll, A. B. (1999). Corporate Social Responsibility: Evolution of a Definitional Construct. Sage. (direct link)

- Carroll, A.B. Carroll’s pyramid of CSR: taking another look. Int J Corporate Soc Responsibility 1, 3 (2016). https://doi.org/10.1186/s40991-016-0004-6

- Casadesus-Masanell, R. (2014). Introduction to Strategy. Harvards Business Publishing

- Dess, G. G., Lumpkin, G. T., & Eisner, A. B. (2010). Strategic management: Text and cases. New York: McGraw-Hill Irwin.

- Lacaze, A., & Ferreira, F. (2020). Adding Value to the VRIO Framework using DEMATEL. Lisbon: ISCTE-IUL. (direct link)

- Levitt, T. (1958). The dangers of social responsibility (pp. 41–50). Harvard business review

- Kim, W. C., & Mauborgne, R. (2004). Blue Ocean Strategy. Harvard Business Review. (direct link)

- Miller, D. (1992), “The Generic Strategy Trap”, Journal of Business Strategy, Vol. 13 No. 1, pp. 37-41.https://doi.org/10.1108/eb039467

- Nagel, C. (2016). Behavioural strategy and deep foundations of dynamic capabilities – Using psychodynamic concepts to better deal with uncertainty and paradoxical choices in strategic management. Global Economics and Management Review, 44-64. (direct link)

- Pearce, J. and Robinson, R. (2009), Strategic Management – Formulation, Implementation and Control, 11th edition, McGraw-hill International Editions

- Porter, M. E. (1979). How Competitive Forces Shape Strategy. Harvard Business Review. (direct link)

- Porter, M. E. (1985). The Competitive Advantage: Creating and Sustaining Superior Performance. NY: Free Press

- Porter, M. E. (1998). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press.

- Porter, M.E., & Kramer, M.R. (2011) ‘Creating shared value’, Harvard Business Review, vol. 89, no. 1/2, pp. 62–77.

- Sharda, R., Delen, D., & Turban, E. (2018). BUSINESS INTELLIGENCE, ANALYTICS, AND DATA SCIENCE: A Managerial Perspective. Pearson.

- Teece, D. J. (2011). Dynamic capabilities: A guide for managers. Ivey Business Journal. (direct link)

- Teece, D. J., Pisano, G., & Shuen, A. (1998). Dynamic capabilities and strategic management. Strategic Management Journal. (direct link)

- Treacy, M., & Wiersema, F. (1993). Customer Intimacy and Other Value Disciplines. Harvard Business Review. (direct link)

- Wernerfelt, B. (1984). The Resource-Based View of the Firm. Strategic Management Journal.

Websites

- https://ebrary.net/99185/business_finance/which_prioritie

- https://managementweekly.org/porters-generic-competitive-strategies/

- https://pitchbook.com/news/articles/bezos-is-coming-mapping-amazons-growing-reach

- https://www.business-to-you.com/ansoff-matrix-grow-business/

- https://www.business-to-you.com/levels-of-strategy-corporate-business-functional/

- https://www.business-to-you.com/porter-generic-strategies-differentiation-cost-leadership-focus/

- https://www.business-to-you.com/value-disciplines-customer-intimacy/

- https://www.business-to-you.com/vrio-from-firm-resources-to-competitive-advantage/

- https://businessjargons.com/internal-environment.html

- https://www.finereport.com/en/data-visualization/a-beginners-guide-to-business-dashboards.html

- https://online.hbs.edu/blog/post/change-management-process