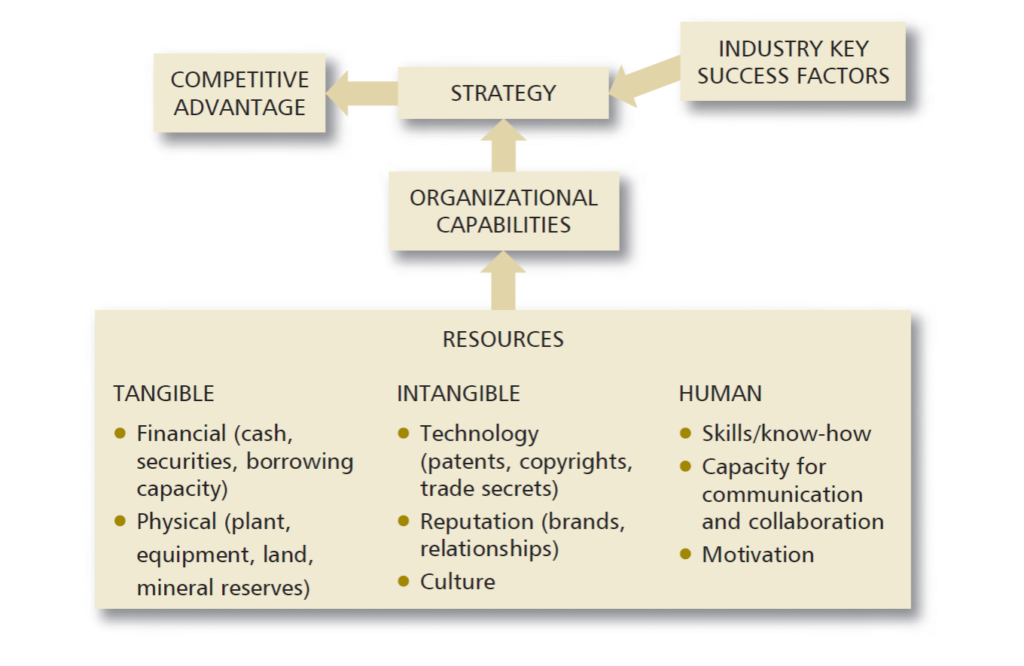

In this chapter, we will focus on the internal environment of the company and on how this could be crucial to its success. Therefore, resources and capabilities are sources of competitive advantage. First of all, it is important to notice that there is a clear distinction between the concepts of resources and capabilities. One can think about the resources as money derived. A company might invest some money and immediately obtain a resource. Capabilities must be developed over time. Put generically: resources refer to what an organization owns, capabilities refer to what the organization can do. For instance, if money is invested in buying a book about a programming language, the buyer will not automatically know how to program. How to program is a capability which will be built over time after investing in resources.

Resources and Capabilities

In a company, an example of a resource can be money available, and an example of a capability is project management, which will help to correctly conduct a project in which the company invested money. Resources can be tangible and intangible. As the name suggests, tangible resources are the ones which can easily be seen as intangible resources are not materialized.

Tangible resources

- A research and development firms’s patents.

- An entertainment company’s library of old movies.

- A restaurant secret recipe.

- A direct marketing firm’s mailing list.

- A natural resources company’s landholdings.

- A hotel chain’s computerized reservation system.

- A furniture manufacturer’s distribution network.

Intangible resources

- A firm’s good reputation.

- A knowledgeable and creative workforce.

- A unifying corporate culture.

- A multinational corporation’s experience with various national governments.

- A high level recognition of community support.

- A visionary leader with strong motivation and communication skills.

The role of resources in Coca-Cola

Having a focus on the external environment is crucial but it is not enough to be positioned in a profitable industry with a well-defined strategy. The company must also be focused on its internal resources and capabilities which are much more stable than the external environment. By its turn, the external environment is unstable and quite dynamic, which could cause several damages to the firm if it is not prepared to react and does not have a stable internal environment.

Above we saw the example of Coca-Cola as a successful company but above all, a successful brand. Coca-Cola does not have an obvious unique internal resource or capability that is the source of its success. The main product of the brand is identical to others without any particular distinguishing feature with very low costs for substitution (i.e.: the consumer could select another similar product without much costs from moving from one to the other). Besides, it does not have any particular way of production that makes it special. However, Coca-Cola has a unique and valuable resource that is its image and marketing. the company’s campaigns are world-wide known, and its brand is recognized almost everywhere. The secret of Coca-Cola is not as much in the taste as it is in its marketing. The company diversified the markets in which it operates and created or bought several other brands to attract different consumers (i.e.: part of the corporate strategy which we will explore later). This is a good example of a unique resource supported by internal capabilities. This is why Coca-Cola is still successful in an extremely competitive market with low margins. The industry in which a company operates and external factors are not enough to explain success.

The role of capabilities in Japanese car industry

The American automotive firms once had more assets than any other in the world, including the best and the biggest plants, the most advanced technologies, the strongest brand, the greatest market share, the largest workforce, and the most extensive distribution network. Particularly, General Motors (GM) which was the leading carmaker company. However, the Japanese competitors developed skills that allowed them to erode the GM’s position, even though the Japanese firms started with a much smaller base of assets. The Japanese developed three set of capabilities:

- lowering costs,

- improve quality,

- designed faster product-development processes.

Resources

It is crucial to distinguish between resources and strategic resources. Sometimes resources such as cash, venues or vehicles are seen as vital for an organization but they might not be strategic. According to Edwards, 2014, when analyzing organizations, common resources such as cash and vehicles are not considered to be strategic resources. Resources such as cash and vehicles are valuable, of course, but an organization’s competitors can readily acquire them. Thus, an organization cannot hope to create an enduring competitive advantage around common resources.

A strategic resource is an asset that is valuable, rare, difficult to imitate, and organization-wide supported.

Apple has many strategic resources, including their proprietary software and hardware platforms, the Apple store, many aspects of the overall buying experience including price, and a culture of innovation. The last point concerning innovation is considered crucial at Apple. Constant innovation can be considered a strategic resource at Apple based on other resources such as human capital (intangible) and patents (tangible). This resource may have generated other such as brand recognition and good reputation. However, this resource might be of little value without the support of capabilities present along the value chain such as operations and marketing.

Capabilities

Resources cannot be seen as separate from capabilities but instead, they should be seen as interconnected. As in a surgical room, a surgeon cannot do much on his own and must be supported by others such as nurses or medical equipment.

An organizational capability is a firm’s capacity to deploy resources for a desired end result.

Grant, 2018

Therefore, as a person is capable of speaking a language a firm is able to produce goods and distribute them worldwide. In both cases a resource is not enough on its own: it is not enough to be intelligent to learn a new language as effort and dedication are also needed.

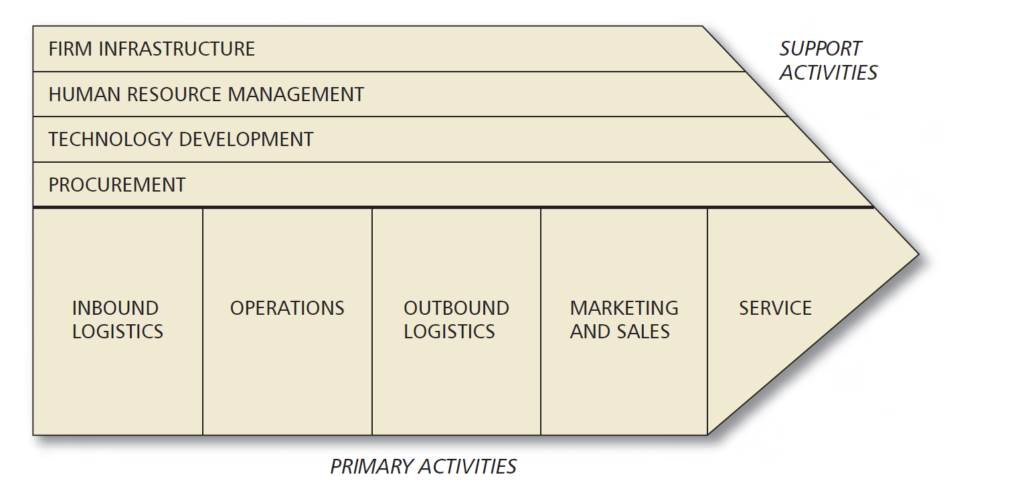

Indeed, there are capabilities which are core to the organization and source of competitive advantage. In order to know which ones are core capabilities, Michael Porter proposed to look at the the company’s value chain. The value chain describes the full chain of a business’s activities in the creation of a product or service, from the initial reception of materials to its delivery to the market, and everything in between. Put simply, the process of transforming inputs in outputs. Value chain concerns the capabilities of the firm (how the firm does), in other words, how the firm uses its resources to create a products or services that generate value for the costumers. Is it the operations or marketing a core capability and a source of competitive advantage? Only by analyzing them can the company get the answer.

The objective of a company is to produce products or services which have greater value to the costumers than their production costs. A systematic way of examining all the internal activities and how they interact is necessary when analyzing the sources of competitive advantage. A company gains competitive advantage by performing strategically important activities more cheaply or better than its competitors, according to Porter, 1985.

The value chain might be integrated in a wider concept, namely, the supply chain which considers both suppliers of input materials and final consumers (who can then re-sell the products or services). For the purpose of this course, the focus in solely on the value chain of the company.

Porter has divided the value chain of a company into primary and support activities.

Primary Activities

The primary activities are the main ones in a company value chain. The primary activities are directly involved in the production and selling of the actual product.

- Inbound Logistics: is where purchased inputs such as raw materials are often taken care of. Examples: material handling and warehousing.

- Operations: once the required materials have been collected internally, operations can convert the inputs in the desired product. Examples: packaging and assembly.

- Marketing and Sales: the fact that products are produced doesn’t automatically mean that there are people willing to purchase them. This is where marketing and sales come into place. It is the job of marketeers and sales agents to make sure that potential customers are aware of the product and are seriously considering purchasing them. Examples: advertising and promotion.

- Service: in today’s economy, after-sales service is just as important as promotional activities. Complaints from unsatisfied customers are easily spread and shared due to the internet and the consequences on your company’s reputation might be vast. It is therefore important to have the right customer service practices in place. Examples: installation or repair.

Support Activities

The support activities should back-up the primary activities being the interconnections among them essential for the success of a company and therefore to obtain a competitive advantage. The support activities go across the primary activities and aim to coordinate and support their functions as best as possible with each other by providing purchased inputs, technology, human resources and various firm wide managing functions.

- Procurement: procurement refers to the function of purchasing inputs used in the firm’s value chain.

- Technology Development (R&D): today value activities tend to embody technology. Therefore R&D is the development of new technological solutions.

- Human Resources Management: consists of activities involved in the recruiting, hiring (and firing), training, development and compensation of all types of personnel.

- Firm Infrastructure: consists of several activities including general (strategic) management, planning, finance, accounting, legal, government affairs and quality management.

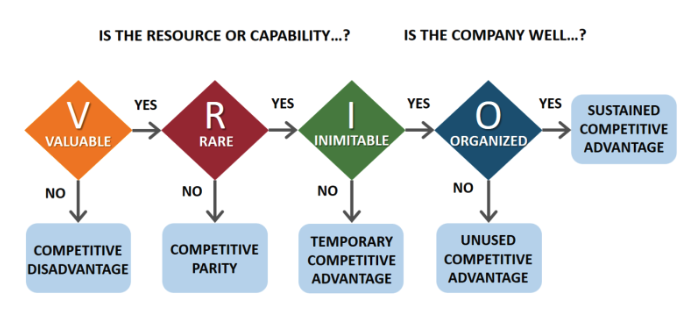

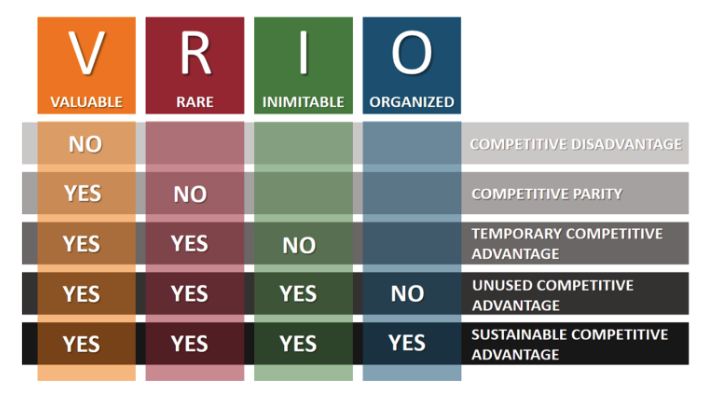

VRIO Model

The VRIO framework was developed by Barney, 1991 and helps to understand which are the strategic resources and capabilities of a company by attributing them certain characteristics. A strategic resource or capability is the one that fulfills all the characteristics of the model.

Generically, the model explores the role of resources. However, this is a wider vision of resource which also includes capabilities. Therefore, in this particular case, capabilities are also seen as a resource which should not be mistaken with the straightforward and distinct definitions of resources and capabilities explored above. Barney, 1991, defines firm resources as including: “all assets, capabilities, organizational processes, firm attributes, information, knowledge, controlled by the firm”. Whenever using the VRIO framework, we are using a broader concept of “resource”, and we should be aware that this definition also includes capabilities.

A strategic resource must be:

Valuable

First and foremost resources must be valuable. They are seen as valuable when they enable a firm to implement strategies that improve a firm’s efficiency and effectiveness by exploiting opportunities or by mitigating threats. Another way to assess whether a resource or investment is valuable is by looking at its Net Present Value (NPV), meaning that the costs invested in the resource should be lower than the expected future cash flows discounted back in time. If non of the resources possessed by a firm are considered valuable, the focal firm is likely to have a competitive disadvantage.

Rare

Secondly, resources must be rare. Resources that can only be acquired by one or few companies are considered to be rare. If a certain valuable resource is possessed by a large amount of players in the industry, each of the players has a capability to exploit the resource in the same way, thereby implementing a common strategy that gives non of the players a competitive advantage. Such a situation is indicated as competitive parity or competitive equality. In case a company does possess a large amount of resources that are valuable and rare, it is likely to have at least temporary competitive advantage.

Inimitable

Although valuable and rare resources may help companies to engage in strategies that other firms cannot pursue since the other firms lack the relevant resources, it is no guarantee for long-term competitive advantage. It may give the focal company a first-mover advantage but competitors will probably try to imitate these resources. Another criteria that resources should meet is therefore that they should be hard and costly to imitate or substitute. Resources can be imperfectly imitable due to a combination of three reasons:

- Unique historical conditions: choices made in the past influence the options a company has in the present and future (path-dependency). Similarly, a company that has located its facilities on what turns out to be a much more valuable location than initially anticipated, has an imperfectly imitable physical resource.

- Causal ambiguity: causal ambiguity exists when the link between the resources controlled by the focal company and its sustainable competitive advantage is not fully understood. Competitors won’t be able to duplicate the focal company, since they simply don’t know which resources they should imitate.

- Social complexity: when the most important resource of a company relies on the strength of its social network, interpersonal relations, a company’s culture and its reputation among both suppliers and customers, the resource can be considered highly inimitable. It is very hard for competitors to build an identical social network, since it is dependent on so many different factors that are linked together in a complex social structure.

Organization-wide supported

The resources themselves do not create any advantage for a company if the company is not organized in way to adequately exploit these resources and capture the value from them. The focal company therefore needs the capability to assemble and coordinate resources effectively. Examples of these organizational components include a company’s formal reporting structure, strategic planning and budgeting systems, management control systems and compensation policies. Without the correct organization to acquire, use and monitor the resources involved, even companies with valuable, rare and imperfectly imitable resources will not be able to create a sustainable competitive advantage. When all four resource attributes are present, a company is safe to assume it has a distinctive competence that can be used as source of sustainable competitive advantage.

A company might be in different positions depending on its resources’ characteristics. The best position that a company might face is the one in which its resources fulfill all the VRIO requirements.

Limitations and current trends of the VRIO framework

This section will analyse some limitations of the VRIO framework and current developments proposed to improve it. The section will be based on the analysis of Lacaze & Ferreira, 2020.There are some limitations to the VRIO framework:

- VRIO generates static and inward looking descriptions as it is completely focused on the internal environment of the firm;

- It is not possible to conduct empirical performance measurement, in other words, we cannot measure the importance of our resources and capabilities compared to other firms due to heterogeneity among them;

- The framework ignores external variables such as market demand;

- The framework assumes firms as completely independent entities but in reality they tend to be connected in a network, for example via alliances. Therefore, the resources belonging to a given company might be shared by others too;

- As it is hard to measure the results of the analysis, it also does not provide very accurate predictions;

The main critique to the framework is exactly its lack of capacity to measure the mutual impact of resources, in other words, as the resources are different from firm to firm we cannot compare them neither measure their impact. For instance, which is the impact of human resources on brand recognition? Surely they must be linked but the VRIO framework does not allow that understanding.

Therefore, recent solutions propose the use of Multiple Criteria Decision Analysis (MCDA) methods to quantify the connections among resources. MCDA helps making decisions by selecting a list of criteria that are important to us when selecting among different choices and give them weights. For example, when buying a house we value location, price and size but in different proportions. Let’s say that in our decision, location is worth 40%, price is worth 40% and size if s worth 20%.

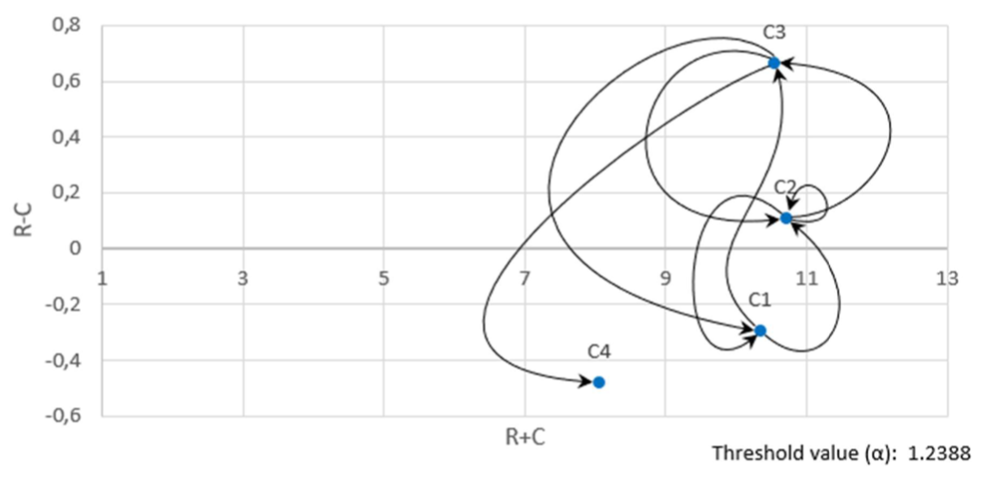

Particularly, it is proposed to use Decision-Making Trial and Evaluation Laboratory (DEMATEL). First, we should identify the resources of a company and classify them according to VRIO. Second, a matrix of influence of the different resources should be created with the help of important stakeholders (i.e.: how much human resources influence brand recognition and vice-versa). Third, via several matrix operations we obtain coefficients that tell us which resources influence and are influenced and clearly measure that influence. The final result is a graph with the mentioned interconnections. This approach may solve one of the biggest issues in the VRIO framework.

Resource-Base View (RBV)

Resource-based theory was developed by Jay Barney (Barney, 1991) and argues that

possession of strategic resources provides an organization with a golden opportunity to develop competitive advantages over its rivals.

Edwards, 2014

Therefore, the RBV is a collection of all the concepts we have analyzed in the current chapter. It tries to explain differential firm performance: why do some firms perform better than others if they operate in the same industry? The focus is purely internal to the company and particularly on its resources. As resources are undissociated from capabilities, this theory also contemplates them.

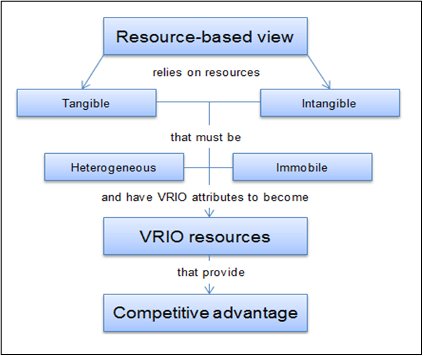

Having in mind that resources must always be exploited by internal capabilities, in summary, the RBV states that companies rely on both tangible and intangible resources that are assumed to be heterogeneous and immobile. Heterogeneous resources means that resources vary from firm to firm. Firms operating in the same industry are different (heterogeneous) and thus have different resources. The different resources lead to different performances. Immobile resources means that resources cannot easily move from company to company, at least in the short term. It also means that competitors cannot rapidly copy a certain firm’s resources. For example, Apple and Samsung operate in the same market for smartphones but their innovation teams are different (heterogeneous) and are hard to replicate by the other because it will cost a lot of money and time (immobile). The resources must also have certain attributes to be considered strategic and provide competitive advantage. These attributes are the ones already explored in VRIO framework.

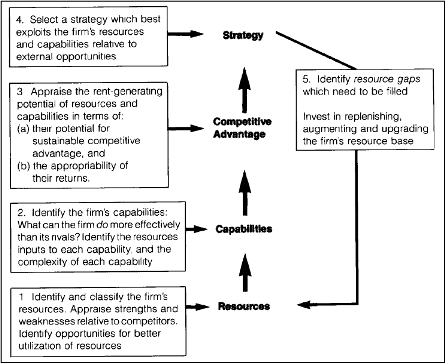

The process of RBV strategic management

As it is clear by now, RBV is a broad framework which integrates several concepts, ideas and sub-frameworks. The RBV process starts with the identification and classification (strategic or not) of resources. The company should assess the strengths and weaknesses towards the competitors.

The next step is to identify the firm’s capabilities and understand what can it do more efficiently than the competition. The resources serve as inputs to the capabilities (i.e.: what the firm has and what can it do). Therefore, the input resources to each capability should be identified. The complexity of each capability should be assessed.

Thirdly, the firm should appraise the potential of the resources and capabilities identified to generate a source of competitive advantage. A competitive advantage appears when a firm is able to produce more efficiently than its competitors providing a valued product/service. Therefore, the resources and capabilities should be analysed in terms of their potential to generate value for the consumer creating a source of competitive advantage and consequently returns to the firm.

The forth step is to define a strategy which allows the best approach to exploit the potential of the resources and capabilities relative to external opportunities.

The process will start again once the firm identifies new resources needed or the existing ones are upgraded, augmented or replenished.If this process is well conducted, the firm will not only obtain a competitive advantage but also a sustained competitive advantage: one that will endure over time and help the firm stay successful far into the future.

We now know that the way of structuring thought in RBV is distinct from other theories. Besides focusing solely on internal resources, RBV assumes a different approach to strategy formulation. RBV looks to the internal resources and capabilities and finds which is the competitive advantage of a company which will be followed by the vision and mission formulation. In other words, other theories state that the company first defines its vision and mission and then they look at the internal and external environment for positioning. However, RBV states that companies will fist look inside at resources and capabilities and define positioning and only after formulate vision and mission. Other vision is similar to the RBV but look also at the external environment.

In the following video, Jay Barney explains RBV

Dynamic capabilities

There are some limitations of the traditional RBV framework, namely:

- Is static and equilibrium-based model similarly to the microeconomic models which proved to be insufficient for business analysis,

- Problem of strategic renewal: core competencies turned into core rigidities in a moving environment,

- Disregards the external environmental as increasingly turbulent and hypercompetitive.

Therefore, a new approach was developed by Teece, Pisano & Shuen in 1998 which tackles the challenges of the external environment together with the internal resources and capabilities. A dynamic capability is the ability of the organization to integrate, build and reconfigure the internal and external competencies in order to deal with a fast paced changing external environment.

The dynamic capabilities theory is a way of analyzing resources and capabilities in order to obtain a competitive advantage in a rapidly changing environment particularly marked by technological change. Basically, dynamic capabilities focuses on what companies need to do to remain competitive. Being a manager is about seizing opportunities and shaping the business environment. Dynamic capabilities is about how firms maintain evolutionary fitness in a challenging environment. There is a difference between dynamic capabilities, which is doing the right things, from ordinary capabilities, which is doing the things right. Several firms which pursue the best practices (ordinary capabilities) go out of business because they deflect their attention and might eventually loose market opportunities. On the other hand, some firms develop a dynamic capability, the unique ability to improve, update, or create new capabilities, especially in reaction to changes in its environment. Said differently, a firm that enjoys a dynamic capability is skilled at continually adjusting its array of capabilities to keep pace with changes in its environment. Google, for example, buys and sells firms to maintain its market leadership over time, and is highly ranked as the most attractive place to work. Apple is capable of building new brands and products as the personal technology market evolves.

The Three Clusters

According to Teece, 2011, dynamic capabilities can be summarized as belonging to three clusters of activities and adjustments which are interconnected:

Sensing

Identification and assessment of a market opportunity. It is a set of capabilities that involves exploring technological opportunities, probing markets, and listening to customers, along with scanning the other elements of the business ecosystem. It requires management to build and “test” hypothesis about market and technological evolution, including the recognition of “latent” demand (not explored demand). The world wasn’t clamoring for a coffeehouse on every corner, but Starbucks, under the guidance of Howard Schultz, recognized and successfully exploited the potential market. As this example implies, Sensing requires managerial insight and vision or an analytical process that can be a proxy for it.

Seizing

Mobilization of resources to address an opportunity and to capture value from doing so. Includes designing business models to satisfy customers and capture value. They also include securing access to capital and the necessary human resources. Employee motivation is vital. Good incentive design is a necessary but not sufficient condition for superior performance in this area. Strong relationships must also be forged externally with suppliers and customers.

Transforming

Continued renewal. These capabilities concern the continuous alignment and realignment of the company’s resources. They are needed most obviously when radical new opportunities are to be addressed. But they are also needed periodically to soften the rigidities that develop over time from asset accumulation and standard operating procedures. A firm’s assets must also be kept in alignment to achieve the best strategic “fit”: firm with ecosystem, structure with strategy, and assets with each other. Complementarities need to be constantly managed (reconfigured as necessary) to achieve evolutionary fitness, avoiding loss of value should market leverage shift to favor external complements.

In a statement, dynamic capabilities are a way of constantly achieve new forms of competitive advantage as companies should always be sensing and seizing new opportunities at the same time that adapt their resources and capabilities to that purpose.

The Blackberry story: failure to innovate

The Blackberry case is an interesting story where a company was doing the things right but not the right things. The company was very successful and market leader in the mobile phone industry. However, it was not able to sense new market opportunities arising from the external environment. If the company is only focused in its internal environment, it will lose track of what is happening outside its walls. In this case, a new demand for a smartphone (i.e.: bigger touch screen and more functions) was appearing and Apple was able to sense it and to create a business model to seize it. On the contrary, Blackberry continued to do the things right and was not able to capture this opportunity. Since then, the company is quite irrelevant in the market but Apple has been able to adjust its internal resources and capabilities to sense and seize new opportunities and align its internal resources to do so.

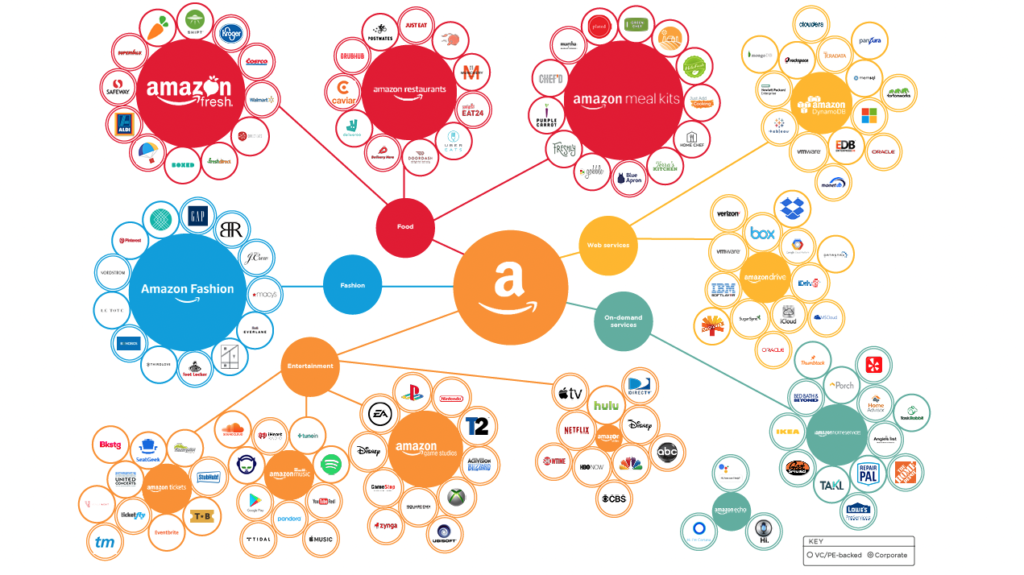

Amazon’s example

Amazon is one of the best examples of the correct usage of dynamic capabilities. The company was able to sense market opportunities and seize them by designing a profitable business model (having in mind internal resources such as human). Furthermore, Amazon is constantly adapting its internal resources and capabilities to maintain its current competitive advantage but also to sense and seize new opportunities. This strategy led to a strong presence and brand recognition in several markets under the umbrella of the Amazon powerful brand. Amazon is currently present in a wide range of industries as we can see in the illustration below.

Resources and References

Main

- Barney, J. & Hesterley S. (2019). Strategic Management and Competitive Advantage: Concepts and Cases. 6th Edition, Pearson.

- Grant, R. (2018). Contemporary Strategy Analysis. 10th Edition. Wiley.

Secondary

- Adam Brandenburger and Barry J. Nalebuff, Co-opetition (New York, NY: Doubleday, 1996)

- Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management.

- Bredrup, H. (1995). Competitiveness and Competitive Advantage. In: Rolstadås, A. (eds) Performance Management. Springer, Dordrecht.https://doi.org/10.1007/978-94-011-1212-3_3

- Boddy, D. (2020). Management: Using Practice and Theory to Develop Skill (8 ed.). Reino Unido: Pearson.

- Carroll, A. B. (1999). Corporate Social Responsibility: Evolution of a Definitional Construct. Sage. (direct link)

- Carroll, A.B. Carroll’s pyramid of CSR: taking another look. Int J Corporate Soc Responsibility 1, 3 (2016). https://doi.org/10.1186/s40991-016-0004-6

- Casadesus-Masanell, R. (2014). Introduction to Strategy. Harvards Business Publishing

- Dess, G. G., Lumpkin, G. T., & Eisner, A. B. (2010). Strategic management: Text and cases. New York: McGraw-Hill Irwin.

- Lacaze, A., & Ferreira, F. (2020). Adding Value to the VRIO Framework using DEMATEL. Lisbon: ISCTE-IUL. (direct link)

- Levitt, T. (1958). The dangers of social responsibility (pp. 41–50). Harvard business review

- Kim, W. C., & Mauborgne, R. (2004). Blue Ocean Strategy. Harvard Business Review. (direct link)

- Miller, D. (1992), “The Generic Strategy Trap”, Journal of Business Strategy, Vol. 13 No. 1, pp. 37-41.https://doi.org/10.1108/eb039467

- Nagel, C. (2016). Behavioural strategy and deep foundations of dynamic capabilities – Using psychodynamic concepts to better deal with uncertainty and paradoxical choices in strategic management. Global Economics and Management Review, 44-64. (direct link)

- Pearce, J. and Robinson, R. (2009), Strategic Management – Formulation, Implementation and Control, 11th edition, McGraw-hill International Editions

- Porter, M. E. (1979). How Competitive Forces Shape Strategy. Harvard Business Review. (direct link)

- Porter, M. E. (1985). The Competitive Advantage: Creating and Sustaining Superior Performance. NY: Free Press

- Porter, M. E. (1998). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press.

- Porter, M.E., & Kramer, M.R. (2011) ‘Creating shared value’, Harvard Business Review, vol. 89, no. 1/2, pp. 62–77.

- Sharda, R., Delen, D., & Turban, E. (2018). BUSINESS INTELLIGENCE, ANALYTICS, AND DATA SCIENCE: A Managerial Perspective. Pearson.

- Teece, D. J. (2011). Dynamic capabilities: A guide for managers. Ivey Business Journal. (direct link)

- Teece, D. J., Pisano, G., & Shuen, A. (1998). Dynamic capabilities and strategic management. Strategic Management Journal. (direct link)

- Treacy, M., & Wiersema, F. (1993). Customer Intimacy and Other Value Disciplines. Harvard Business Review. (direct link)

- Wernerfelt, B. (1984). The Resource-Based View of the Firm. Strategic Management Journal.

Websites

- https://ebrary.net/99185/business_finance/which_prioritie

- https://managementweekly.org/porters-generic-competitive-strategies/

- https://pitchbook.com/news/articles/bezos-is-coming-mapping-amazons-growing-reach

- https://www.business-to-you.com/ansoff-matrix-grow-business/

- https://www.business-to-you.com/levels-of-strategy-corporate-business-functional/

- https://www.business-to-you.com/porter-generic-strategies-differentiation-cost-leadership-focus/

- https://www.business-to-you.com/value-disciplines-customer-intimacy/

- https://www.business-to-you.com/vrio-from-firm-resources-to-competitive-advantage/

- https://businessjargons.com/internal-environment.html

- https://www.finereport.com/en/data-visualization/a-beginners-guide-to-business-dashboards.html

- https://online.hbs.edu/blog/post/change-management-process

Pingback: Change management how to approach to solutions - nomadOso

Pingback: Control Systems for Business and Decision Support - nomadOso