Once a strategy is selected it is crucial to control for its proper implementation and detect problems. Strategic control fulfills this role and can be defined as: concerned with tracking a strategy as it is being implemented, detecting problems or changes in its underlying premises, and making necessary adjustments (Pearce at al., 2009). Strategic control differs from operational control (taken at functional or business levels) as the second deals with day-to-day activities and the achievement of objectives. For example, if a factory is experiencing a high level of defects in production, the operational control might take measures as retrain the employees and the strategic control should evaluate the overall hiring strategy and onboarding in order to keep strategy on track. The analysis on this section is based on Pearce at al., 2009.

Types of strategic control

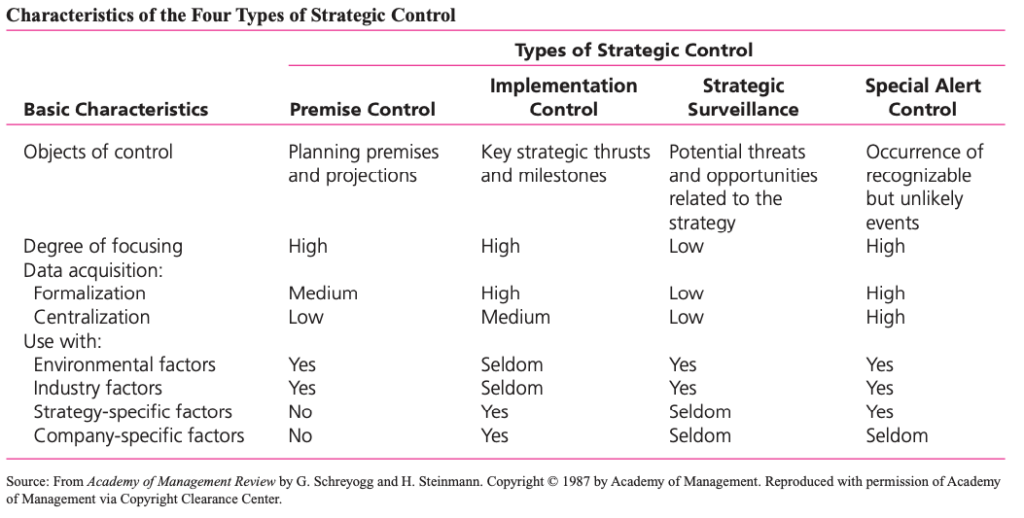

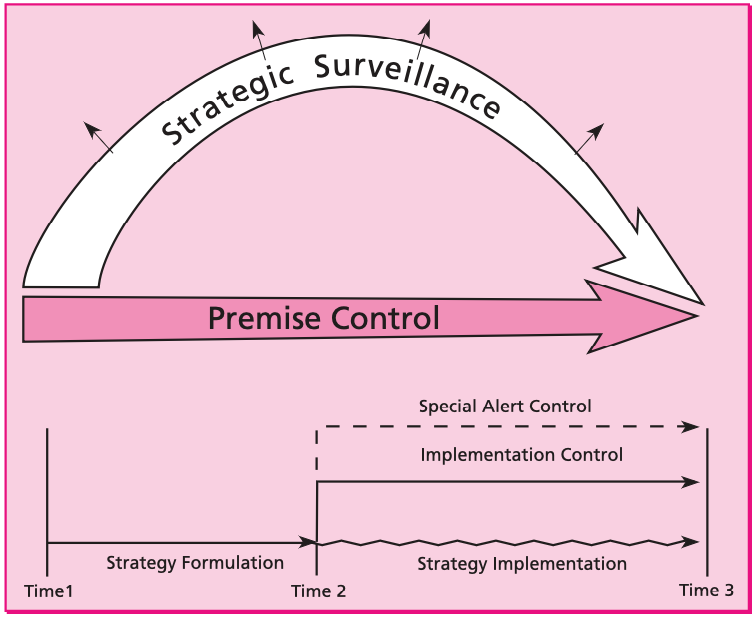

Strategic control control is concerned with two main topics: (1) moving in the right direction (i.e.: adjustment of the strategy) and (2) performance (i.e.: objectives and schedules are being met, costs and revenues are within the projections). Strategic control is like “steering control” in which the company regularly checks if the strategy is still on track. There are 4 types of strategic control:

- Premise (fundamental idea) control: check systematically and continuously whether the premises on which the strategy is based are still valid. If the company finds that a crucial premise is no longer valid, the strategy needs to be changed. As soon as this issue is spotter, the better, as it give the company time to revise the strategy on time. These control type is based on control checks (i.e.: periodical evaluations). Premise control is based on the following factors:

- Environmental: the external environment is out of the company’s control but strategies are based on key premises about it. Examples are inflation, interest rates, regulation or demographics (i.e.: PESTEL analysis). For example, the changes in interest rates may cause a firm to struggle to obtain financing via bonds.

- Industry: the key premises of the strategy are also affected by industry factors such as competitors, suppliers, product substitutes, and barriers to entry (Porter’s 5 forces). For example, if a key supplier goes out of business the company might suffer consequences. The company should focus on changes that are likely and that will have a great impact on it as this surveillance if quite expensive.

- Strategic surveillance: contrary to premise control strategic surveillance is not based on periodical focused checks but tries to monitor a broad range of events inside and more often outside the firm that are likely to affect the course of its strategy over time. The idea is to keep monitoring broad and general factors because unexpected events might happen suddenly. To do this the firms need to use different sources of information.

- Special alert control: are the actions taken very rapidly to reconsider a firm’s strategy because of a sudden and unexpected event. For example, the tragic event of the 9/11 caused a complete disruption in several firms which needed to rapidly adjust. Imagine a company which had the strategic goal of performing an IPO on the day of the attacks. The plans must be adjusted.

- Implementation control: the implementation of the strategy takes time and takes place to the implementation on several steps, programs and moves along a period of time. Implementation control is used to assess whether the overall strategy should be changed in light of the results obtained in the implementation. For example, the results are not going according to the plan. Implementation control has two basic types:

- Monitoring projects: strategy requires the implementation of smaller projects (i.e.: hire new people or obtain new suppliers). Monitoring the course of these projects is important to get a sense of the overall strategy implementation.

- Milestone reviews: milestones are important objectives that need to be achieved at a certain point in time. Their non-completion can compromise the schedule and therefore, the entire strategy. It is crucial to monitor and review milestones along the strategy implementation. For example, Boeing has invested millions of dollars and several years developing a project regarding supersonic transport (Boeing 2707). Nevertheless, the competition from Airbus (Concorde) was fierce which led to milestones revision (i.e.: research, tests or hiring people) and this had an impact on the overall strategy.

The Balanced Scorecard

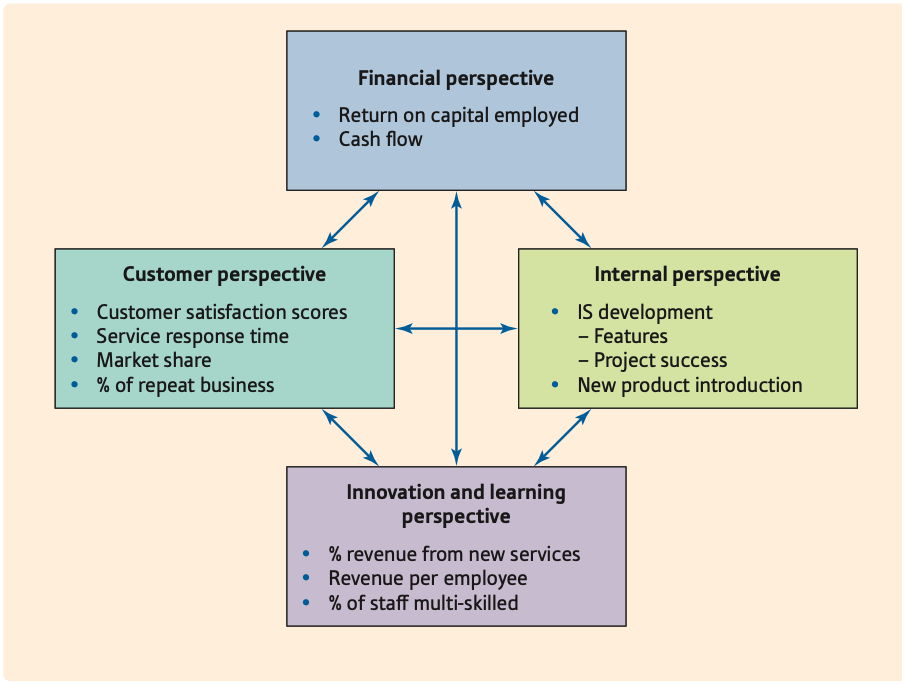

A solution linking operational and strategic control in order to have a track of the strategy implementation is the Balanced Scorecard (BSC) system developed by Robert Kaplan and David Norton. This system provides a quantitative analysis to the most important topics that a firm must keep track when monitoring the implementation of a strategy. This perspective links financial and operations outcomes which are usually analysed separately. The system proposes four perspectives which suppose feedback among them:

- Innovation and learning perspective: how well are we continuously improving and creating value? The scorecard insists on measures related to innovation and organizational learning to improve performance leadership, product development or operational process improvement.

- Internal perspective: what are our core competencies and areas of operational excellence? Internal business processes and their effective execution as measured by productivity, quality measures, and various cost measures.

- Costumer perspective: how satisfied are our customers? A customer satisfaction perspective typically adds measures related to defect levels, on-time delivery, warranty support or product development that come from direct customer input.

- Financial perspective: how are we doing for our shareholders? A financial perspective typically uses measures like cash flow, return on equity, sales, and income growth.

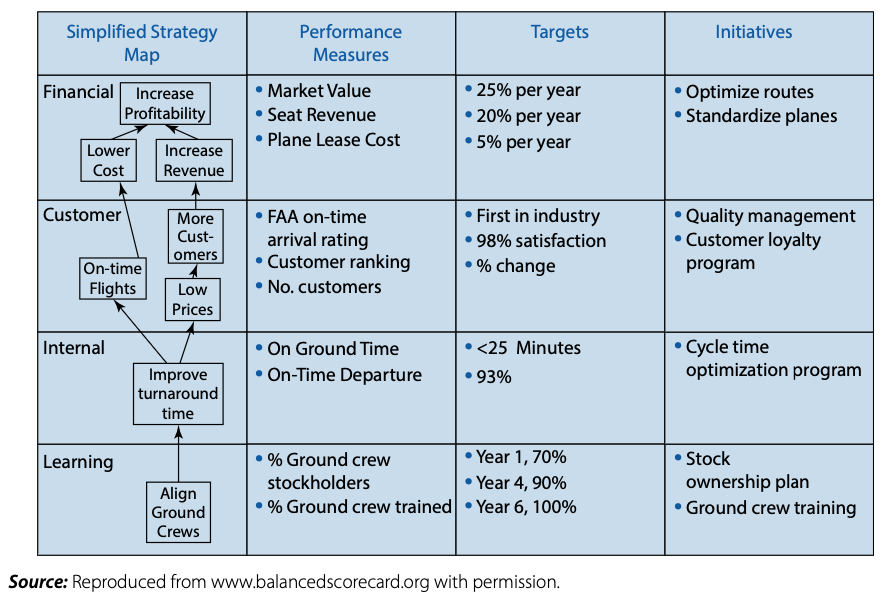

The system proposes to create macro-objectives related with the strategy and performance measures related with them. We then need to set targets to each measure and initiatives to achieve the targets. It is also important to keep track of these targets regarding the current performance. For instance, if the year is closing and we have 80% of the number of people predefined hired, this lacks 20% behind what was initially established.

An example is provided above concerning an airline company. This company wants to increase profitability in a financial perspective which will favor shareholders. It will measure the performance on this area through market value of the company (e.g.: price of the shares). The target is an improvement of 25% per year and the initiatives to achieve this are to optimize the routes and standardize the planes.

Strategic Management and Control Processes

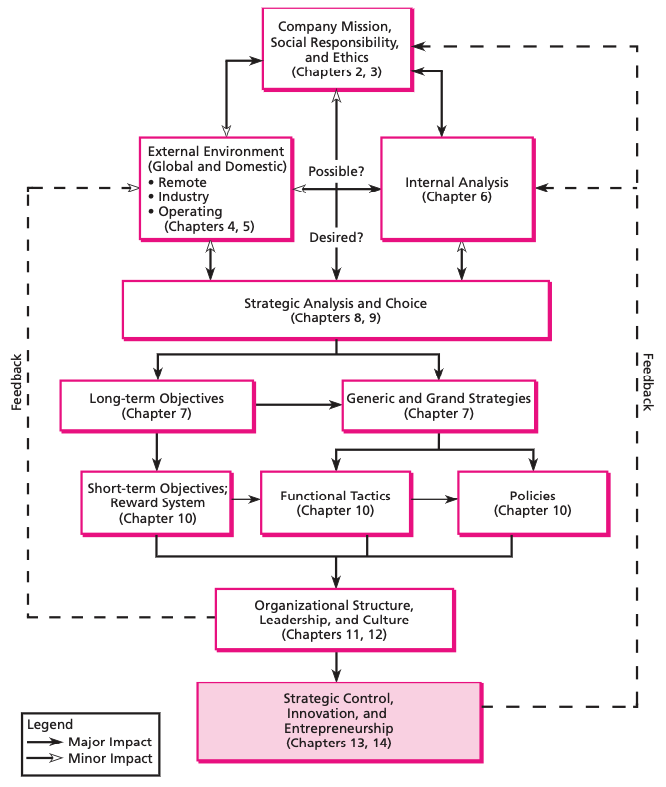

We have seen before the strategic management process which was concluded with the strategy implementation. Now we know that the strategy implementation will need to be monitored via the control process. It is of extreme important to have feedback along the process in order to be able to adapt and ultimately have the real perspective of how is the company performing.

Resources and References

Main

- Barney, J. & Hesterley S. (2019). Strategic Management and Competitive Advantage: Concepts and Cases. 6th Edition, Pearson.

- Grant, R. (2018). Contemporary Strategy Analysis. 10th Edition. Wiley.

Secondary

- Adam Brandenburger and Barry J. Nalebuff, Co-opetition (New York, NY: Doubleday, 1996)

- Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management.

- Bredrup, H. (1995). Competitiveness and Competitive Advantage. In: Rolstadås, A. (eds) Performance Management. Springer, Dordrecht.https://doi.org/10.1007/978-94-011-1212-3_3

- Boddy, D. (2020). Management: Using Practice and Theory to Develop Skill (8 ed.). Reino Unido: Pearson.

- Carroll, A. B. (1999). Corporate Social Responsibility: Evolution of a Definitional Construct. Sage. (direct link)

- Carroll, A.B. Carroll’s pyramid of CSR: taking another look. Int J Corporate Soc Responsibility 1, 3 (2016). https://doi.org/10.1186/s40991-016-0004-6

- Casadesus-Masanell, R. (2014). Introduction to Strategy. Harvards Business Publishing

- Dess, G. G., Lumpkin, G. T., & Eisner, A. B. (2010). Strategic management: Text and cases. New York: McGraw-Hill Irwin.

- Lacaze, A., & Ferreira, F. (2020). Adding Value to the VRIO Framework using DEMATEL. Lisbon: ISCTE-IUL. (direct link)

- Levitt, T. (1958). The dangers of social responsibility (pp. 41–50). Harvard business review

- Kim, W. C., & Mauborgne, R. (2004). Blue Ocean Strategy. Harvard Business Review. (direct link)

- Miller, D. (1992), “The Generic Strategy Trap”, Journal of Business Strategy, Vol. 13 No. 1, pp. 37-41.https://doi.org/10.1108/eb039467

- Nagel, C. (2016). Behavioural strategy and deep foundations of dynamic capabilities – Using psychodynamic concepts to better deal with uncertainty and paradoxical choices in strategic management. Global Economics and Management Review, 44-64. (direct link)

- Pearce, J. and Robinson, R. (2009), Strategic Management – Formulation, Implementation and Control, 11th edition, McGraw-hill International Editions

- Porter, M. E. (1979). How Competitive Forces Shape Strategy. Harvard Business Review. (direct link)

- Porter, M. E. (1985). The Competitive Advantage: Creating and Sustaining Superior Performance. NY: Free Press

- Porter, M. E. (1998). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press.

- Porter, M.E., & Kramer, M.R. (2011) ‘Creating shared value’, Harvard Business Review, vol. 89, no. 1/2, pp. 62–77.

- Sharda, R., Delen, D., & Turban, E. (2018). BUSINESS INTELLIGENCE, ANALYTICS, AND DATA SCIENCE: A Managerial Perspective. Pearson.

- Teece, D. J. (2011). Dynamic capabilities: A guide for managers. Ivey Business Journal. (direct link)

- Teece, D. J., Pisano, G., & Shuen, A. (1998). Dynamic capabilities and strategic management. Strategic Management Journal. (direct link)

- Treacy, M., & Wiersema, F. (1993). Customer Intimacy and Other Value Disciplines. Harvard Business Review. (direct link)

- Wernerfelt, B. (1984). The Resource-Based View of the Firm. Strategic Management Journal.

Websites

- https://ebrary.net/99185/business_finance/which_prioritie

- https://managementweekly.org/porters-generic-competitive-strategies/

- https://pitchbook.com/news/articles/bezos-is-coming-mapping-amazons-growing-reach

- https://www.business-to-you.com/ansoff-matrix-grow-business/

- https://www.business-to-you.com/levels-of-strategy-corporate-business-functional/

- https://www.business-to-you.com/porter-generic-strategies-differentiation-cost-leadership-focus/

- https://www.business-to-you.com/value-disciplines-customer-intimacy/

- https://www.business-to-you.com/vrio-from-firm-resources-to-competitive-advantage/

- https://businessjargons.com/internal-environment.html

- https://www.finereport.com/en/data-visualization/a-beginners-guide-to-business-dashboards.html

- https://online.hbs.edu/blog/post/change-management-process